How long is your startup runway?

Something to consider when deciding how to launch your startup is whether you're going to build it in your spare time, or save enough money to cover your living expenses while you work on it full time. If you choose the second option you'll want to work out how long your money is likely to last you -- entrepreneurs often refer to this period as your "startup runway".

I've tried building a product in the evening and at weekends, and it's not for me, so I've saved up a bit of money and stopped freelancing to work on Agile Planner full time. The first thing I did was to calculate how long I've got before the cash runs out.

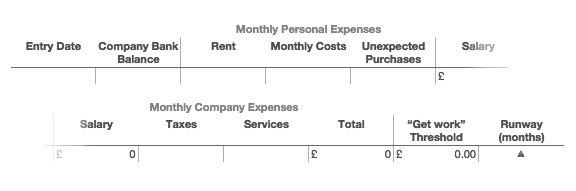

For a company with one or two founders, it's a fairly easy calculation to make. You can see the spreadsheet that I'm using here (I've split one row in the spreadsheet into two halves, so it fits on the page):

If you fancy playing along you can download it for Numbers.app or Excel.

The calculation

Let's take a look at what's going on...

The first column is today's date. I'll be revisiting this calculation every month to make sure that my estimate is always up to date. Once you've worked out how much you've saved, enter that in the "Company Bank Balance" column.

Now we need to know how much it costs us to survive a month. I'm paying myself a small salary and have estimated how much money I spend each month.

How much money do you think you spend a month? I've entered my estimate into "Monthly Costs". If you're not sure how much you'll spend its time to start tracking it. I'm using Envelopes on the iPhone which is a low ceremony approach to getting a handle on where your money goes. The good news is that you don't need to remember to track everything for long; you only need to get a good feel for how much you ought to put in that spreadsheet cell.

I'm probably being optimistic about how much I spend a month, so I've assumed that I'll spend some money this month on things I haven't yet thought of and entered that number into "Unexpected Purchases".

The "Salary" column is simply the sum of all my monthly personal expenses. My company's outgoings are:

- "Taxes" due on my salary (that means PAYE and NIC, if you're in the UK), and

- "Services" that I might need to spend money on, such as freelance web design.

Imagine the worst happened, and nobody wanted to buy your product. How long would it take you to sort out an alternative source of income (i.e. get a job)? To leave myself a financial cushion I've assumed I'll be able to find another client project within six weeks, so I've worked out what I'd spend in six weeks and called that the "Get Work Threshold".

The number of months in your runway is just your bank balance, minus your Get Work Threshold, divided by your company's total monthly expenses.

Of course, Eric Ries defines the length of your startup's runway as the number of pivots you can make before you run out of money. Anybody have any idea on how to calculate pivots per month? ;-)